Negative Goodwill Tax Treatment

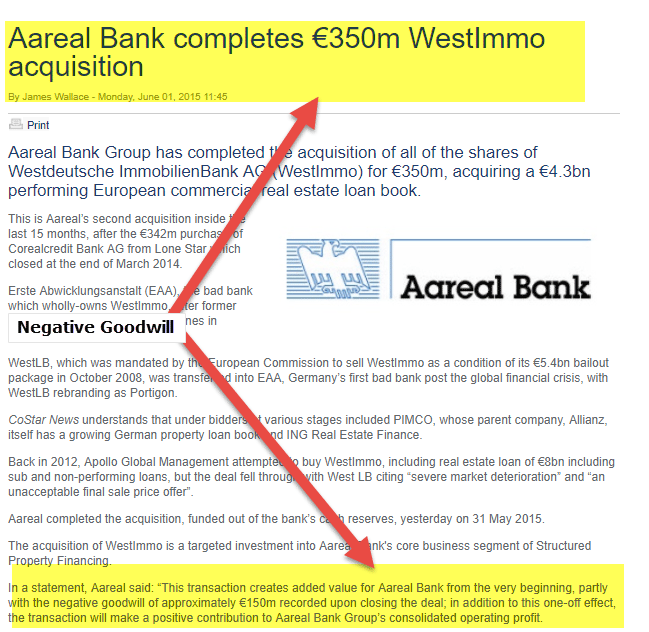

Negative goodwill tax treatment. Accounting treatment of negative goodwill Once it is confirmed that resultant is negative goodwill than the resulting gain should be recognized in the profit and loss at the acquisition date in the books of acquirer ie. The corporation tax treatment of goodwill has changed several times since the introduction of the intangibles regime in 2002. Negative goodwill NGW arises on an acquirers financial statements when the price paid for an acquisition is less than the fair value of its net tangible assets.

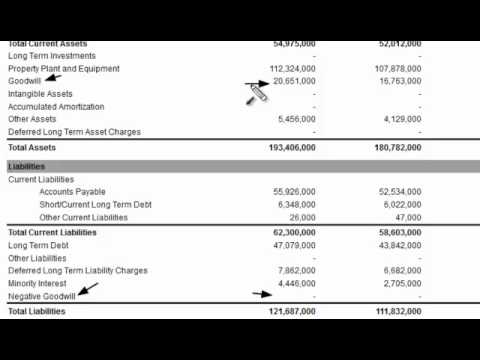

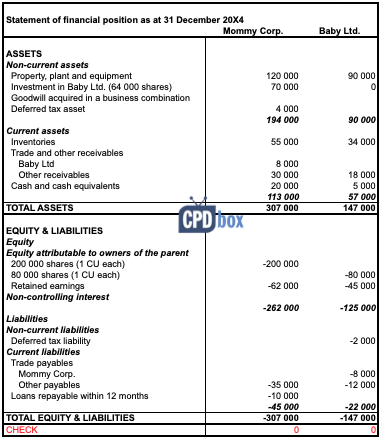

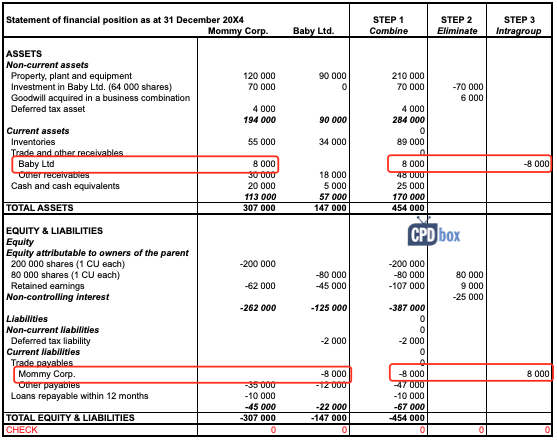

Under UK GAAP negative goodwill appears on the asset side of the balance sheet of a company as a negative figure immediately after any positive goodwill and is normally written off by being. This is because when the acquired assets are fair valued under FRS 102 in the acquiring companys books the aggregate fair value of the acquired assets exceeds the consideration paid. It will be taken as a gain in the consolidated income statement of the acquirer.

However one major difference is that FRS 102 requires negative goodwill to be deferred and recognised on face of the statement of financial position. Goodwill negative or positive does not feature in tax computations at this stage. The Tax Court held however that no goodwill passed to the taxpayers since any goodwill of the business was due to the personal ability business acquaintanceship and other individualistic qualities of the husband and found that the corporation did not have any value beyond its tangible assets since the husbands personal ability was not a corporate asset and there was not a contract or.

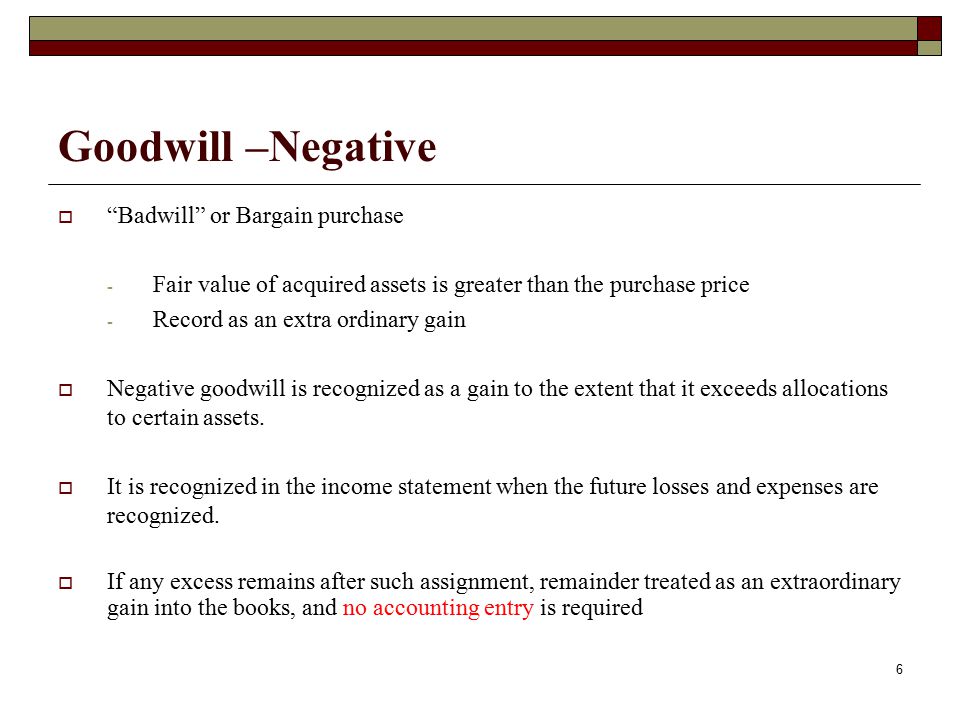

Negative goodwill is the opposite of goodwill. In many cases such transactions gave rise to negative goodwill in the hands of the purchaser. Relief you can get.

At the risk of stating the obvious tax-deductible goodwill is attractive to an acquirer because it will reduce acquirer taxes going forward after the acquisition. Negative Goodwill is a term coined in the context of one company taking over another. I wanted some clarity as to how this negative goodwill should be treated in practice due to presence of investment properties.

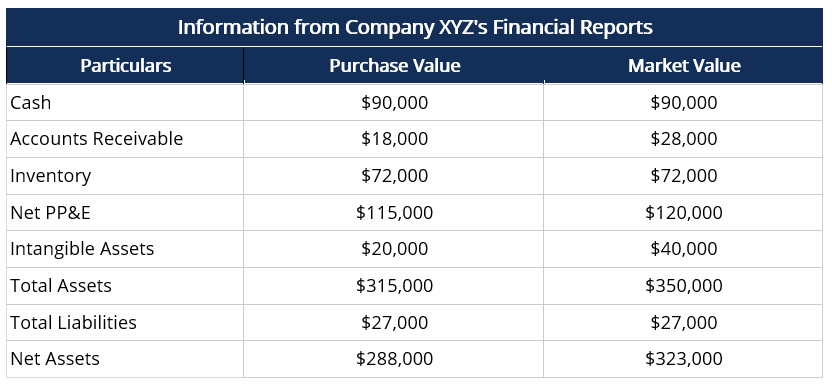

So the negative goodwill in this case is 30 million - 35 million. Negative goodwill indicates that the selling party is in a. There are three steps to follow where negative goodwill arises.

The negative goodwill NGW amount also known as the bargain purchase amount is the difference between the purchase price paid for an asset and its actual fair market value. Its again occurring to the former when the consideration paid for an acquisition is less than the fair market value of its net tangible assets.

Negative goodwill is an accounting principle that occurs when the price paid for an asset is lower than its value in the market and can be thought of as a discount to the buyer.

If you do this then the write off figure is added back in tax computations. This is because when the acquired assets are fair valued under FRS 102 in the acquiring companys books the aggregate fair value of the acquired assets exceeds the consideration paid. In literal terms Negative Goodwill implies a bargain purchase. Negative goodwill NGW refers to a bargain purchase amount of money paid when a company acquires another company or its assets. Reassess the identification and measurement of the acquirees assets liabilities and provisions for contingent liabilities and the measurement of the cost of the combination. Under UK GAAP negative goodwill appears on the asset side of the balance sheet of a company as a negative figure immediately after any positive goodwill and is normally written off by being. If the purchase price for the same company is 30 million subtract the value of the companys assets 35 million from this number to get goodwill. Accounting for negative goodwill under FRS 102. Negative goodwill is the opposite of goodwill.

How Does Negative Goodwill Work. If you do this then the write off figure is added back in tax computations. I wanted some clarity as to how this negative goodwill should be treated in practice due to presence of investment properties. Any goodwill created in an acquisition structured as a stock sale is non tax deductible and non amortizable. Where companies have been active in acquiring goodwill and other intangible assets over a number of years they need to track the amortisation of intangibles to treat each part correctly in accordance with the legacy position. This is because when the acquired assets are fair valued under FRS 102 in the acquiring companys books the aggregate fair value of the acquired assets exceeds the consideration paid. How Does Negative Goodwill Work.

/financial-statement--pen-and-calculator-on-table-1056767352-2494fc4d57674fb68f434061f777107c.jpg)

Posting Komentar untuk "Negative Goodwill Tax Treatment"